“How much would it cost to buy all the properties in Telford?”

This fascinating question was posed by the 14-year-old son of one of my Telford landlords when they both popped into my offices before the Christmas break (doesn’t that seem an age away now!). I thought to myself, that over the Christmas break, I would sit down and calculate what the total value of all the properties in Telford are worth … and just for fun, work out how much they have gone up in value since his son was born back in the autumn of 2002.

In the last 14 years, since the autumn of 2002, the total value of Telford property has increased by 76% or £3.75 billion to a total of £8.69 billion. Interesting, when you consider the FTSE100 has only risen by 68.9% and inflation (i.e. the UK Retail Price Index) rose by 39.7% during the same 14 years.

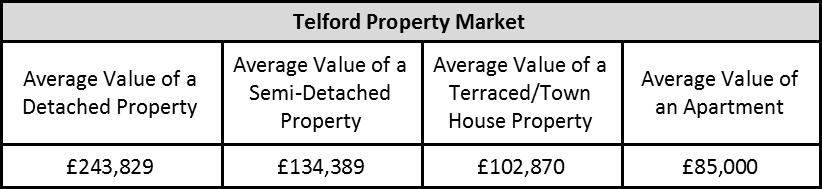

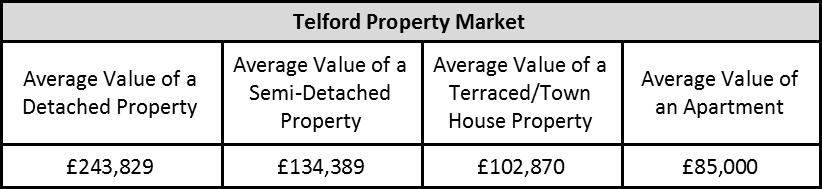

When I delved deeper into the numbers, the average price currently being paid by Telford households stands at £151,002.… but you know me, I wasn’t going to stop there, so I split the property market down into individual property types in Telford; the average numbers come out like this ..

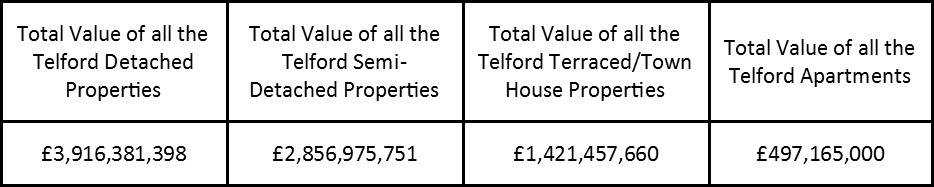

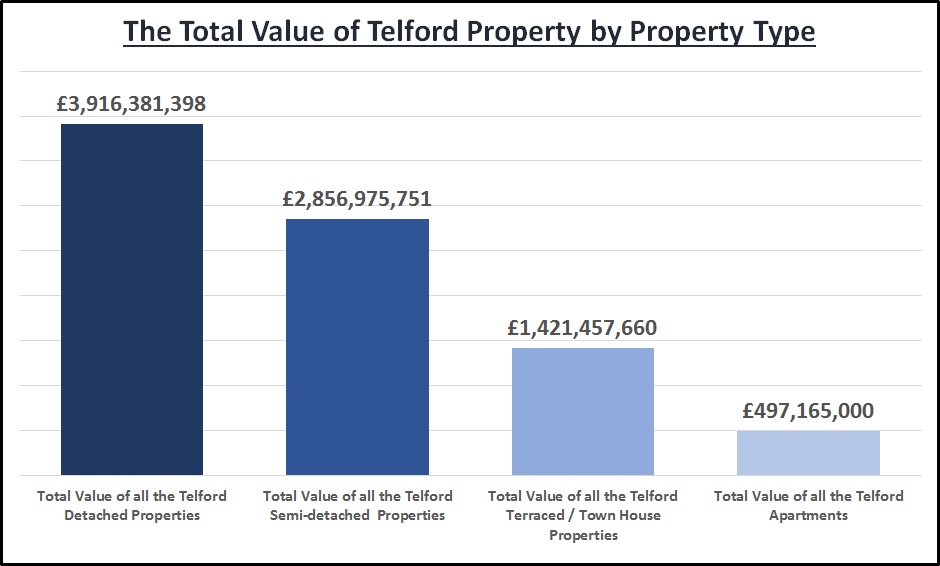

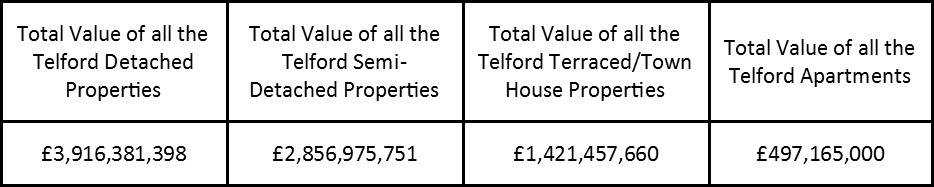

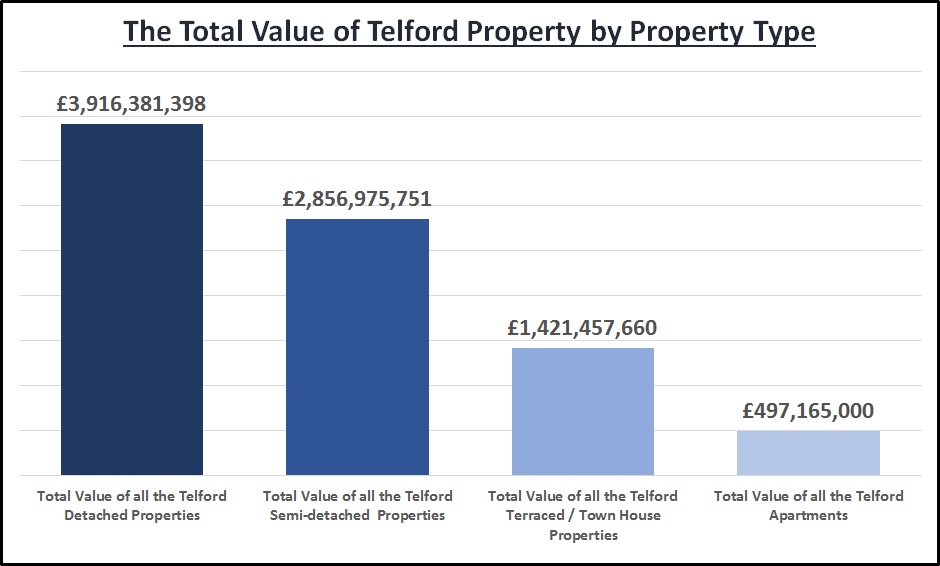

… yet it got even more fascinating when I multiplied the total number of each type of property by the average value. As detached houses are so expensive, when you compare them with the much cheaper terraced/town houses and apartments, you can quite clearly see how valuable detached properties are in terms of total pound note value, when compared to the value of the terraced/town houses and apartments.

So, what does this all mean for Telford? Well as we enter the unchartered waters of 2017 and beyond, even though property values are already declining in certain parts of the previously over cooked Central London property market, the outlook in Telford remains relatively good as over the last five years, the local property market was a lot more sensible than central London’s.

Telford house values will remain resilient for several reasons. Firstly, demand for rental property remains strong with continued immigration and population growth. Secondly, with 0.25 per cent interest rates, borrowing has never been so cheap and finally the simple lack of new house building in Telford not keeping up with current demand, let alone eating into years and years of under investment – means only one thing – yes it might be a bumpy ride over the next 12 to 24 months but, in the medium term, property ownership and property investment in Telford has always, and will always, ride out the storm.

In the coming weeks, I will look in greater detail at my thoughts for the 2017 Telford Property Market. As always, all my articles can be found at the Telford Property Market Blog www.telfordpropertyblog.com

… yet it got even more fascinating when I multiplied the total number of each type of property by the average value. As detached houses are so expensive, when you compare them with the much cheaper terraced/town houses and apartments, you can quite clearly see how valuable detached properties are in terms of total pound note value, when compared to the value of the terraced/town houses and apartments.

… yet it got even more fascinating when I multiplied the total number of each type of property by the average value. As detached houses are so expensive, when you compare them with the much cheaper terraced/town houses and apartments, you can quite clearly see how valuable detached properties are in terms of total pound note value, when compared to the value of the terraced/town houses and apartments.

So, what does this all mean for Telford? Well as we enter the unchartered waters of 2017 and beyond, even though property values are already declining in certain parts of the previously over cooked Central London property market, the outlook in Telford remains relatively good as over the last five years, the local property market was a lot more sensible than central London’s.

Telford house values will remain resilient for several reasons. Firstly, demand for rental property remains strong with continued immigration and population growth. Secondly, with 0.25 per cent interest rates, borrowing has never been so cheap and finally the simple lack of new house building in Telford not keeping up with current demand, let alone eating into years and years of under investment – means only one thing – yes it might be a bumpy ride over the next 12 to 24 months but, in the medium term, property ownership and property investment in Telford has always, and will always, ride out the storm.

In the coming weeks, I will look in greater detail at my thoughts for the 2017 Telford Property Market. As always, all my articles can be found at the Telford Property Market Blog www.telfordpropertyblog.com

So, what does this all mean for Telford? Well as we enter the unchartered waters of 2017 and beyond, even though property values are already declining in certain parts of the previously over cooked Central London property market, the outlook in Telford remains relatively good as over the last five years, the local property market was a lot more sensible than central London’s.

Telford house values will remain resilient for several reasons. Firstly, demand for rental property remains strong with continued immigration and population growth. Secondly, with 0.25 per cent interest rates, borrowing has never been so cheap and finally the simple lack of new house building in Telford not keeping up with current demand, let alone eating into years and years of under investment – means only one thing – yes it might be a bumpy ride over the next 12 to 24 months but, in the medium term, property ownership and property investment in Telford has always, and will always, ride out the storm.

In the coming weeks, I will look in greater detail at my thoughts for the 2017 Telford Property Market. As always, all my articles can be found at the Telford Property Market Blog www.telfordpropertyblog.com